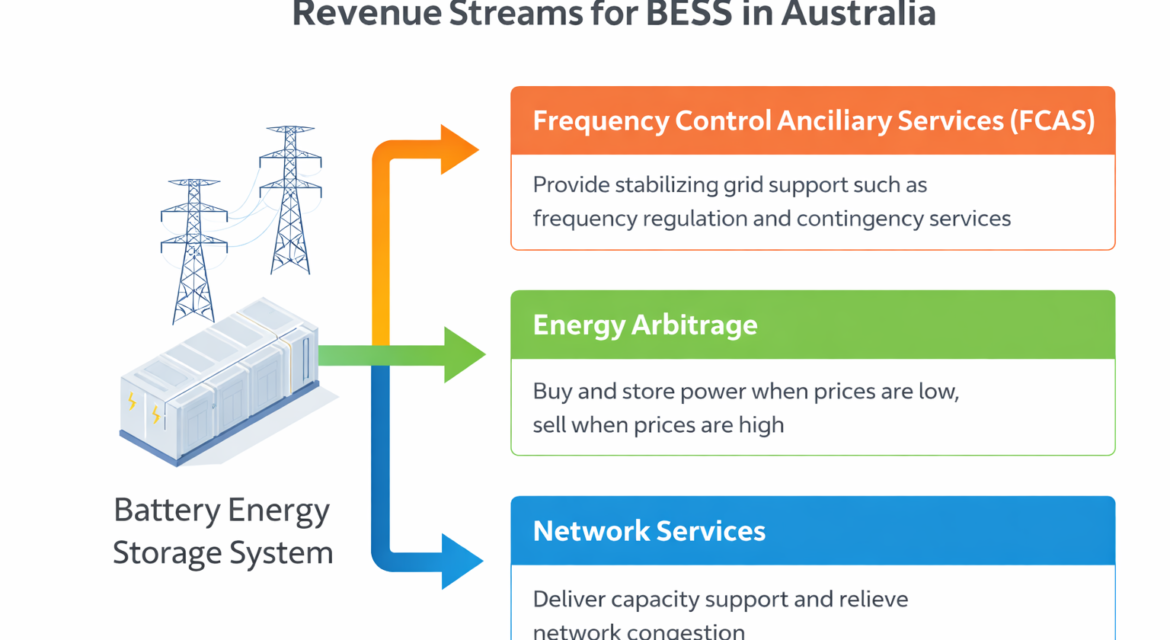

FCAS BESS revenue Australia is now a major driver of returns for Battery Energy Storage Systems (BESS) as batteries move from “grid support” to commercial market participants in Australia’s National Electricity Market (NEM). For utility-scale batteries and hybrid solar-plus-battery projects, revenue typically comes from two main streams:

- Frequency Control Ancillary Services (FCAS)

- Energy arbitrage (buy low, sell high)

In practice, FCAS BESS revenue Australia depends on enabled MW, availability, verification performance, and operating strategy.

This article explains how both work in practice, what the main FCAS market types are, and why engineering design and grid connection strategy can materially change bankable revenue outcomes. For official definitions and market context, refer to AEMO’s Ancillary Services overview, the AEMO Guide to Frequency Control Ancillary Services (PDF), and the Market Ancillary Services Specification (MASS) and FCAS verification tools.

1. What is FCAS?

Frequency Control Ancillary Services (FCAS) are services procured by the Australian Energy Market Operator (AEMO) to help keep the power system operating securely around 50 Hz. When supply and demand are out of balance, system frequency moves away from 50 Hz. FCAS helps arrest and correct these deviations through fast response capability (see AEMO’s official overview).

2. Why FCAS markets matter more as renewables grow

As Australia’s grid transitions toward higher penetrations of inverter-based generation (solar and wind), the system has less traditional synchronous inertia. That shift increases the importance of fast active power response, tight frequency control, and verified performance and compliance.

For related context on approvals and grid connection processes, see ElectraGlobe’s article on AEMO accelerating grid connection approval of renewable projects.

3. FCAS markets in Australia

FCAS is typically discussed in two groups:

3.1 Regulation FCAS

Regulation FCAS manages continuous, small frequency deviations. It is used to fine-tune frequency control as conditions vary, with requirements outlined in the AEMO FCAS Guide.

3.2 Contingency FCAS

Contingency FCAS manages larger disturbances (e.g., sudden generator or load trips). Contingency services are designed to respond quickly enough to arrest frequency movement and help return it toward normal ranges. Technical requirements and verification frameworks are covered in the AEMO FCAS Guide (PDF) and the MASS + FCAS verification tools.

Optional deeper references: Very Fast FCAS market transition and Fast Frequency Response (FFR) initiatives.

4. FCAS BESS revenue Australia: How batteries earn from FCAS

FCAS revenue is generally power-driven (MW capability and performance), not energy-driven (MWh throughput). A battery can earn FCAS revenue without deep cycling, which can reduce degradation compared with heavy arbitrage cycling.

What typically affects FCAS revenue in practice:

- Enabled FCAS capacity (MW)

- Availability (time enabled and compliant)

- Performance verification requirements

- Control system tuning and inverter response capability

- Market price volatility

AEMO’s verification approach is referenced through the Market Ancillary Services Specification (MASS) and FCAS tools.

4.1 FCAS BESS revenue Australia: what affects revenue in practice

Assume:

- Enabled FCAS capacity: 20 MW

- Average FCAS price: $15/MW/hr

- Availability: 85%

- Hours per year: 8,760

Annual FCAS revenue (illustrative):

20 × 15 × 8,760 × 0.85 = $2,232,600 per year

This is simplified. Actual outcomes depend on dispatch conditions, enablement volumes, constraints, and compliance.

5. Energy arbitrage explained

Energy arbitrage is charging when wholesale prices are low (or negative) and discharging when prices are high. Arbitrage is energy-driven (MWh throughput), so round-trip efficiency, cycling limits, and degradation assumptions matter.

| Time Block | Typical Price Signal | Battery Action (Illustrative) |

|---|---|---|

| Midday (high solar) | Low / Negative | Charge |

| Evening peak | High | Discharge |

| Overnight | Medium / Low | Optional charge (forecast-dependent) |

6. Arbitrage revenue calculation example (illustrative)

Assume:

- Usable energy: 40 MWh

- Round-trip efficiency: 88%

- Average price spread: $120/MWh

- Cycles per year: 250

Annual arbitrage revenue (illustrative):

40 × 120 × 250 × 0.88 = $1,056,000 per year

This is gross revenue and does not include network charges, availability constraints, or operational limits.

Across both markets, FCAS BESS revenue Australia improves when the battery is sized, controlled, and commissioned for verified performance.

7. Revenue stacking: FCAS + arbitrage

Most grid-scale batteries aim to stack revenues. In practice, this becomes a technical design and operating strategy problem: the battery must deliver FCAS response while maintaining headroom and state-of-charge, while also capturing arbitrage opportunities without breaching constraints or compliance requirements.

| Revenue Stream | What it pays for | Commercial note |

|---|---|---|

| FCAS | MW response capability and performance | Often less energy throughput than arbitrage; compliance and enablement are critical |

| Energy Arbitrage | MWh shifted from low-price to high-price periods | Driven by price spreads, efficiency, cycling limits, and constraints |

| Stacked Operation | Combining FCAS + arbitrage | Requires deliberate operating strategy and SoC headroom management |

8. Why power-to-energy ratio matters

FCAS is primarily a power (MW) market. Arbitrage is primarily an energy (MWh) market. Two batteries with the same energy (MWh) can have very different FCAS capability depending on inverter power (MW) and control response. Correct sizing depends on market strategy, connection constraints, and compliance requirements.

| Battery Type | Power (MW) | Energy (MWh) | Typical Commercial Bias |

|---|---|---|---|

| High-power BESS | 50 | 100 | Stronger FCAS capability (power-focused) |

| Energy-heavy BESS | 25 | 100 | Stronger duration and arbitrage bias (energy-focused) |

| Balanced BESS | 50 | 200 | Can stack FCAS + arbitrage (strategy-dependent) |

9. Solar farms and hybrid FCAS participation

Hybrid solar-plus-battery projects can unlock value that solar alone cannot reliably capture, including improved dispatch flexibility, reduced curtailment impacts (project-dependent), stronger FCAS participation pathways, and better alignment with evening peak pricing.

Related ElectraGlobe reading: Solar farm projects leading Australia’s renewable transition, Utility solar energy and BESS, and Energy transition and BESS projects.

10. What can limit FCAS and arbitrage revenue in real projects

- Connection agreements and export/import limits

- Control system tuning and response performance

- Plant controller / inverter settings and compliance envelopes

- Testing, verification, and ongoing compliance requirements

- Degradation modelling and cycling constraints

- Network and operational constraints (project-specific)

Related ElectraGlobe reading: How concept design shapes renewable project success, Steady-state vs dynamic studies, and Owner’s engineering services.

11. How ElectraGlobe supports renewable energy projects

ElectraGlobe is an Australian engineering consultancy supporting utility-scale renewables, including solar farms and BESS, with services such as:

- Concept and detailed electrical design for solar and hybrid projects

- Grid connection studies and compliance support

- Steady-state and dynamic performance studies

- Commissioning support and technical advisory (project-dependent)

- Owner’s engineering and interface management across disciplines

Services: ElectraGlobe services overview, Steady-state and dynamic studies, and Owner’s engineering services.

For most projects, improving FCAS BESS revenue Australia starts with grid connection and controls, not trading.

12. Key takeaways for FCAS BESS revenue Australia

- FCAS is a power-driven market based on MW response capability and performance

- Arbitrage is an energy-driven strategy based on MWh throughput and price spreads

- Revenue stacking requires deliberate technical and operational strategy

- Power-to-energy ratio selection changes achievable FCAS and arbitrage outcomes

- Availability, verification, and compliance directly affect FCAS earnings

- Connection limits and constraints can cap commercial outcomes

FAQs – FCAS, BESS, Solar Farms and Consultancy

What does FCAS stand for in Australia?

FCAS stands for Frequency Control Ancillary Services. AEMO uses ancillary services to manage the power system safely, securely, and reliably, including maintaining frequency around 50 Hz (see AEMO’s overview).

How many FCAS markets are there?

AEMO defines multiple FCAS services across regulation and contingency categories. Requirements and participation rules are described in the AEMO FCAS guide (PDF) and the MASS.

What is energy arbitrage for BESS?

Energy arbitrage is charging when prices are low and discharging when prices are high. Revenues depend on price spreads, efficiency, cycling limits, and constraints.

Why do grid connection studies matter for BESS revenue?

Grid connection limits, compliance requirements, and control system performance can materially change what a battery can deliver to the market. Early engineering decisions often reduce redesign risk and improve bankability.

Contact ElectraGlobe: electraglobe.com/contact